- May 17, 2024

For calculating taxable income under the UAE Corporate Tax law (the CT law), general rules for determining taxable income- defined under Article 20 of the Corporate Tax Law (CT law) are to be considered. According to Article 20 (2) of the CT law – taxable income for a tax period shall be calculated by considering accounting income and making specific adjustments defined under Article 20 (2); the first adjustment is for – any unrealized gains or losses under UAE Corporate Tax.

In this article, we will see how unrealized gains and losses are treated and how they impact the computation of Taxable income. We will first understand the Term realisation principle with ‘Unrealized Gain /Unrealized Loss’.

What is the realisation principle, and when is income realised for UAE Corporate Tax purposes?

As under many other Corporate Tax systems, the UAE Corporate Tax regime allows Taxable Persons to apply the realisation principle for determining their Taxable Income. This means that income will be taxable, and a deduction would be allowed only when a gain or loss is realised. Realisation would happen, for example, when the relevant asset is sold or terminated

Under the realisation principle, the Taxable Income for each Tax Period would exclude unrealized gains and losses in respect of assets or liabilities that are subject to fair value or impairment accounting or held on the capital account, depending on the election made by the Taxable Person.

What are Unrealized Gains and Losses Under UAE Corporate Tax?

Let’s have a look at unrealized gains and losses specifically:

Unrealized Gains:

In simple terms, the gains which have not yet been realised in cash are known as unrealized gains. For example, items such as financial instruments, which are liquid and short-term, are subject to the fair value of accounting.

An unrealized gain is an increase in the value of an asset or investment that has not been realised in cash; it becomes a realised gain when the asset or investment is sold.

Unrealized Losses:

The losses that have not yet been suffered or occurred are unrealized.

An unrealized loss is a decrease in the value of an asset or investment that has not been realised in cash; it becomes a realised loss when the asset or investment is sold.

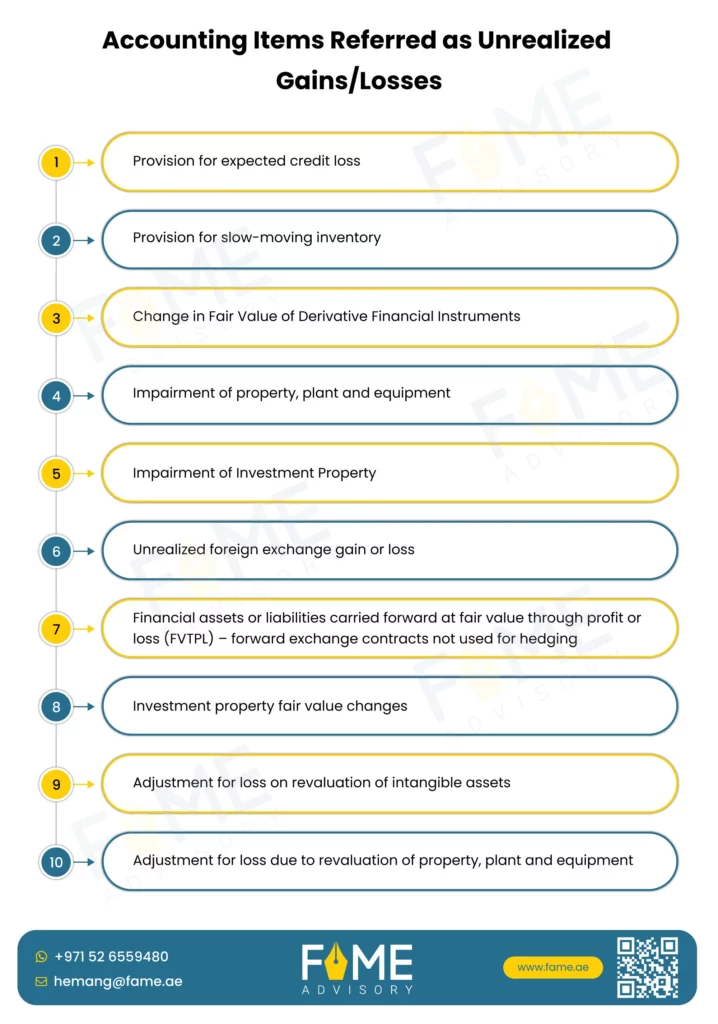

Following accounting items can be referred to as unrealized gain/loss:

- Provision for expected credit loss;

- Provision for slow-moving inventory;

- Derivate financial instruments;

- Impairment of property, plant and equipment;

- Impairment of investment property;

- Unrealized foreign exchange gain or loss;

- Financial assets or liabilities carried forward at fair value through profit or loss (FVTPL) – forward exchange contracts not used for hedging;

- Investment property fair value changes;

- Adjustment for loss on revaluation of intangible assets.

- Adjustment for loss due to revaluation of property, plant and equipment;

What will treating the Unrealized Gains and Losses Under UAE Corporate Tax be?

While computing taxable income for the relevant tax period, a taxable person who prepares their financial statements using the accrual basis of accounting may elect the following option:

Option 1: No Election

Unrealized gains/losses on assets and liabilities held on both capital and revenue accounts will be treated as taxable or deductible as they arise. i.e., on” Accrual Basis. Accordingly, no corresponding adjustment for provisions shall be made while computing taxable income.

Option 2: Election to recognise gains or losses on a “Realisation Basis” for UAE CT Purpose for all assets and liabilities

The Taxable Person can elect to recognise gains and losses on a ‘realisation basis’ for UAE Corporate Tax purposes for all assets and liabilities that are subject to fair value or impairment accounting – that is, any and all unrealized gains would not be taxable (and conversely, any and all unrealized losses would not be deductible) until they are realized. Any unrealized gains or losses on all capital and revenue items need to be adjusted in the computation of taxable income.

Gains and losses incurred with respect to the assets and liabilities which are valued at their fair value or impairment accounting as per the applicable accounting standards shall not be taken into consideration while calculating the Taxable Income subject to the election made to tax gain/losses on realisation basis

- For assets categorised as capital items (property, plant & equipment,) the unrealized gains will not be taxable until they are realised (Ex. At the disposal of assets or investments) subject to the election made to tax gain/losses on a realisation basis.

- Once an option to tax on a realisation basis is elected, the Taxable person cannot claim a tax deduction for unrealized losses on capital items under UAE tax law. The deduction benefit only applies to realised losses when you sell the asset or investment. That means a loss on revaluation of assets that can occur due to a decrease in the asset’s value cannot be claimed as a deduction as there is no actual economic loss. The actual loss incurred at the time of the sale of assets will be allowed as a deduction during the computation of Taxable Income.

Option 3: Election to recognise gains or losses on a “Realisation Basis” for UAE CT Purpose for all assets and liabilities held on Capital Account only

The Taxable Person can elect to recognise gains and losses on a ‘realisation basis’ for UAE Corporate Tax purposes for all assets and liabilities held on capital account only (i.e. not expected to be sold or traded during the regular course of the business operations) – that is, only unrealized gains and losses in respect of all assets and liabilities held on the capital account would not be taxable or deductible, respectively, until they are realised. Any unrealized gain or loss on a capital item must be adjusted in the computation of taxable Income.

Unrealized gains and losses arising from assets and liabilities held on the revenue account, on the other hand, would continue to be included in Taxable Income on a current basis. Any unrealized gain or loss on a capital item needs to be adjusted in the computation of taxable Income.

As per Clause 4 Article 20 of the UAE CT Law,

“Assets held on capital account” refers to assets that the Person does not trade, assets eligible for depreciation, or assets treated under applicable accounting standards as property, plant and equipment, investment property, intangible assets, or other non-current assets.

“Liabilities held on capital account” refers to liabilities, the incurring of which does not give rise to deductible expenditure under Chapter Nine of this Decree-Law, or liabilities treated under applicable accounting standards as non-current liabilities.

Options 2 and 3 mentioned above, as prescribed under Article 20(3) of the CT law, are available only to taxable persons who prepare their financial statements on an accrual basis. Therefore, a taxable person using the accrual method of accounting may choose the realisation basis or decide not to elect any option, which means no corresponding adjustments for provisions will be made while computing the taxable income.

A taxable person, other than a bank or insurance provider, who prepares financial statements on an accrual basis of accounting may elect to consider gains and losses on a realisation basis. The election for the realisation basis must be made by the Taxable Person during the first Tax Period, which will be practically at the time of submitting the first Tax Return. The election to use the realisation basis is irrevocable. However, it may be revoked under exceptional circumstances and approval by the FTA

Adjustments allowed to be made under these methods

As per ministerial decision No. 134 of 2023, In case a Taxable Person who prepares financial statements on an accrual basis may elect to take into account gains and losses on a realisation basis about all assets and liabilities that are subject to fair value or impairment accounting and assets/liabilities held on capital account under the applicable accounting standards, the following adjustments shall be made:

- Exclude depreciation, amortisation, or other change in the value of assets other than financial assets, to the extent adjustment amount related to a change in the net book value exceeding the original cost of the asset;

- Exclude change in value, including amortisation of liability or a financial asset, except gain or loss arising upon realisation of liability or financial assets;

Case Study for Treatment of Unrealized Gains and Losses Under UAE Corporate Tax

This case study covers the important aspects of unrealized gains and losses under UAE Corporate tax taking the example of UAE resident companies.

Adjustment of Taxable Income in case of an asset held on capital account

During the Financial Year ending 31 December 2024, an LLC, a UAE resident company, recognised a revaluation gain in its financial statements of AED 1,000,000 for some buildings, measured at fair value.

The original cost of the building was AED 4,000,000 and after making the revaluation the net book value of the building is AED 5,000,000. The building was not sold at the end of the tax period and, therefore, the revaluation gain is considered ‘unrealised.’

Adjustment to be made while computing the taxable income

During the Financial Year ending 31 December 2024, an LLC, a UAE resident company, recognised a revaluation gain in its financial statements of AED 1,000,000 for some buildings, measured at fair value.

The original cost of the building was AED 4,000,000 and after making the revaluation the net book value of the building is AED 5,000,000. The building was not sold at the end of the tax period and, therefore, the revaluation gain is considered ‘unrealised.’

If no election is made

An LLC would be subject to tax on the unrealized gain of AED 1,000,000 in relation to the Tax Period ending on 31 December 2024.

If election is made

An LLC would be subject to tax on the unrealized gain of AED 1,000,000 in relation to the revaluation of capital assets (i.e. Building) during the Tax Period ending on 31 December 2024.

If election is made

An LLC would be subject to tax on the unrealized gain of AED 1,000,000 in relation to the revaluation of capital assets (i.e. Building) during the Tax Period ending on 31 December 2024.

If the election is made to tax on a realisation basis

the realisation basis in respect of all assets and liabilities that are subject to fair value or impairment accounting (Option 2), then the company would have to exclude the revaluation gain of AED 1,000,000 when calculating their Taxable Income for this Tax Period.

Adjustment of Taxable Income in case of an asset held on revenue account

Company Y specialises in kitchen appliances. Due to shifts in the market, Company Y anticipates the need to discount some of its products to facilitate their sale. Consequently, it created a provision for a slow-moving inventory of AED 100,000 at the end of its fiscal period. At this time, Company Y still holds the inventory, so the loss recorded in its financial statement is considered unrealised

If no election is made or option 3 is elected

If no option is elected or option 3 is elected, then said provision debited to profit and loss shall be allowed as a deduction under CT law while computing the taxable income

If the election is made and Option 2 is elected

If the election is made to recognize the gain or loss on realisation basis for all assets and liabilities including the revenue items (Option 2) then adjustment need to made while computing the taxable income and consequently said provision shall not be allowed as a deduction.

Conclusion

The treatment of unrealized gains or losses under the UAE Corporate Tax Law significantly impacts the computation of taxable income for businesses.

Understanding the unrealized gains and losses under UAE corporate tax is crucial, as they represent changes in asset values that have not yet been realized in cash.

UAE Corporate Tax law provides options for accounting for these gains and losses, either through the fair value method or by considering assets and liabilities held in capital accounts. The decision to make an election regarding the realization basis must be carefully considered, as it can have long-term implications and is generally irrevocable except under exceptional circumstances

Taxable persons must analyse the benefits and drawbacks of each option to determine the most advantageous approach for their specific circumstances. Furthermore, seeking professional assistance from tax consultants can greatly facilitate the process of calculating taxable income, ensuring accurate classification of assets, and smooth operations while minimising errors.

Ultimately, a thorough understanding of the treatment of unrealized gains and losses is essential for businesses to comply with UAE tax regulations and optimise their tax liabilities