- October 16, 2024

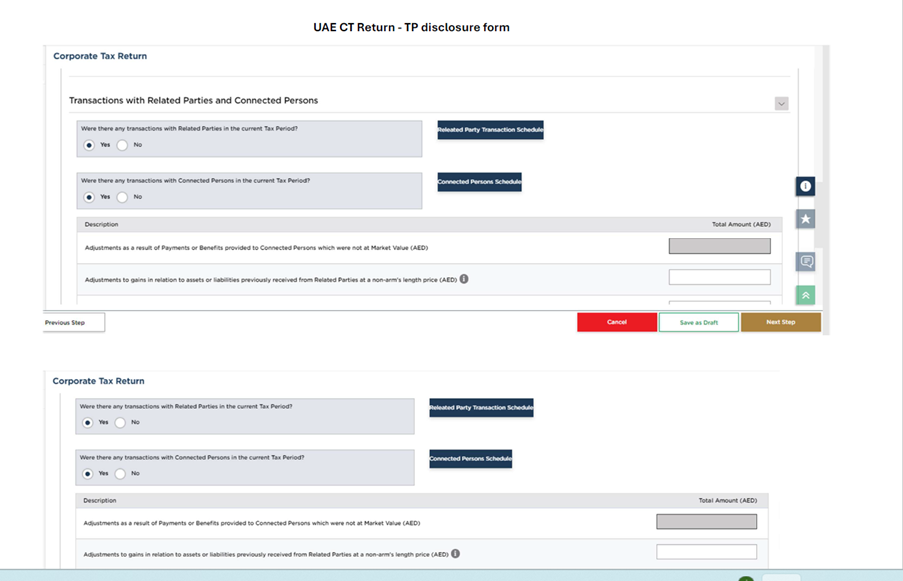

The Federal Tax Authority (FTA) has recently updated the Corporate Tax (CT) return form, particularly concerning the Transfer Pricing Disclosure Form (TP Disclosure Form). Now, taxable persons must disclose transactions with Related Parties and Connected Persons in the TP Disclosure Form.

With the introduction of Corporate Tax in the UAE, the TP Disclosure Form is a crucial element of CT Returns. It ensures transparency in related party transactions and plays a significant role in determining a Taxable Person’s tax liabilities.

It is worthwhile to note that it is an integral part of the CT Return process and these additional details are considered as part of the TP disclosure form. It is not a separate stand-alone form to be filled and filed but one of the segments/components of the CT return form.

In the TP Disclosure form, FTA seeks the following information to be provided by the Taxpayer:

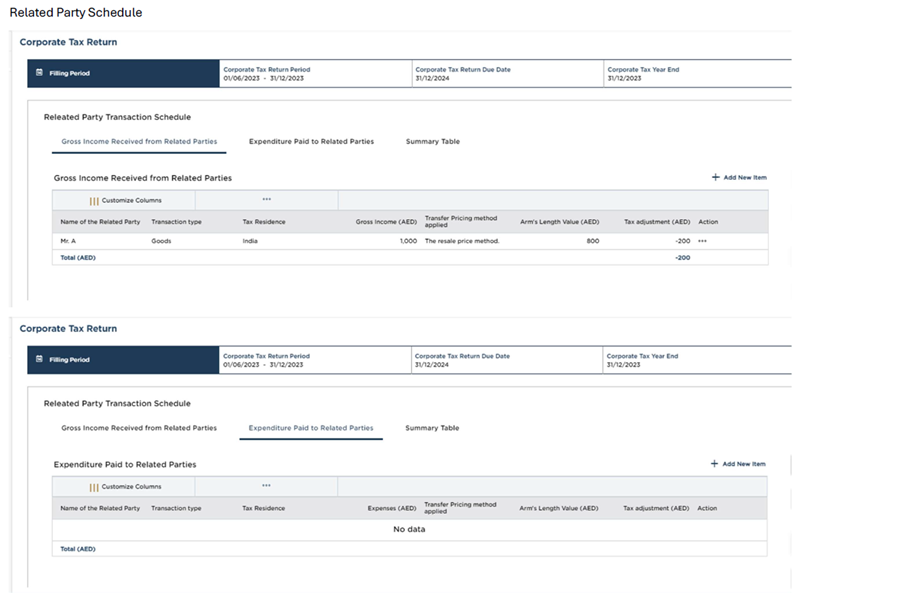

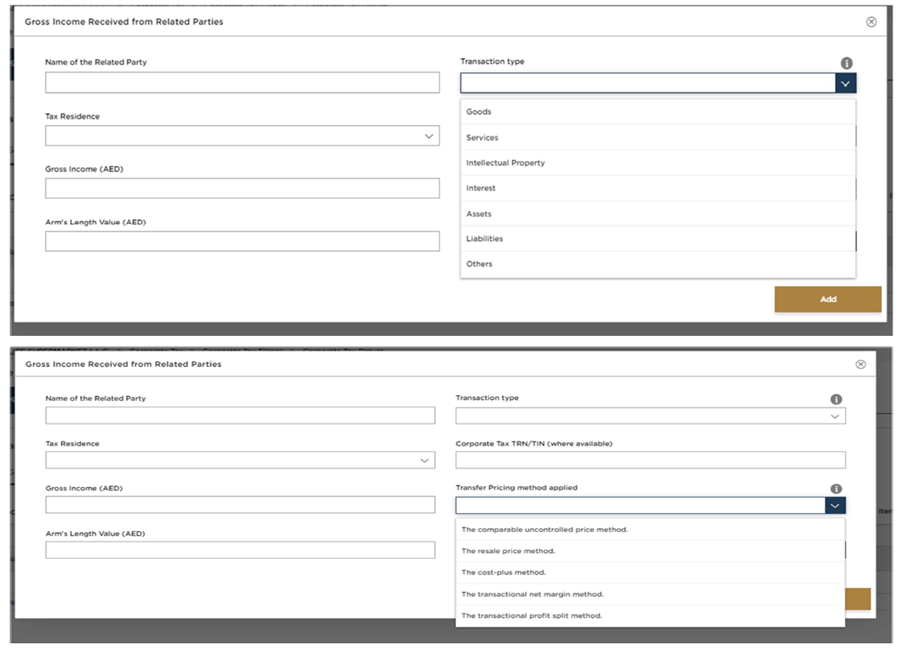

Related Party Transactions Reporting Schedule Requirements

- Legal Full Name of the Related Party (RP)

- Transaction Type with RP

- Country of Tax Residence of the related party

- Corporate Tax TRN of RP

- Gross Value of Transaction with RP in AED

- TP method adopted (TNMM, CUP, CPM, RPM)

- Arm Length Value (shall be determined from the benchmarking conducted during the tax period)

- Tax Adjustment (Difference of Income/expense & Arm Length Value)

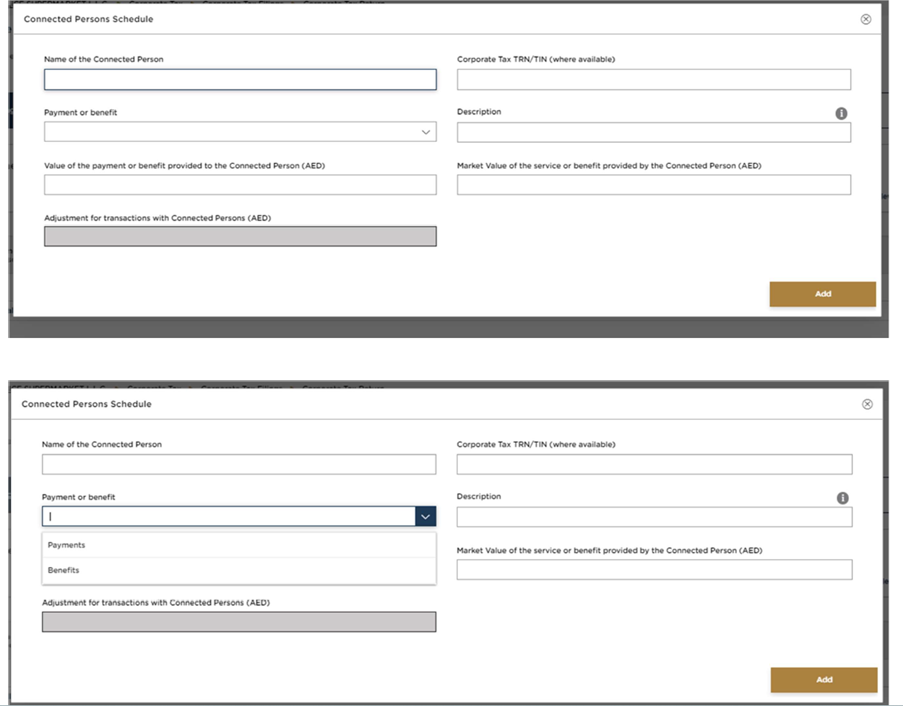

Payments/ Benefits to Connected Persons Reporting Requirements

- Full Name of the Connected Person (CP)

- Corporate Tax TRN of CP

- Payment made or benefit provided to CP

- Description of payment or benefit provided to CP

- Actual value of payment or benefit to be provided in AED

- Market value of payment or benefit (shall be determined from the benchmarking conducted during the tax period)

- Tax Adjustment (Difference of Income/expense & Arm Length Value)

This comprehensive disclosure form aims to ensure compliance with the newly introduced UAE corporate tax law, allowing the tax authorities to evaluate the arm’s length nature of related party transactions effectively. Since the details required are many, we would urge Corporate not to take the TP compliance lightly. Unless one has carried out a Benchmarking exercise, one will not be able to complete and fill in the above details or will not have sufficient documentation to justify the market value or arm’s length value for the transaction and this needs to be done for each of the related party / connected person transactions.

Note: Accurate and complete disclosure is essential to remain compliant and avoid penalties. TP form is an integrated part of the CT Return and is required to be submitted along with the CT Return. Therefore, failure to submit the TP form/ CT Return would lead to a penalty of:

- AED 500 per month for the first 12 months

- AED 1,000 per month from the 13th month onwards