The Taxation Society UAE recently hosted an exceptional event centered on the latest developments in UAE Corporate Tax and Emiratisation Law, bringing together key industry leaders, professionals, and experts in the field of taxation. The evening was marked by insightful discussions, networking opportunities, and the unveiling of a highly anticipated resource for professionals in the sector.

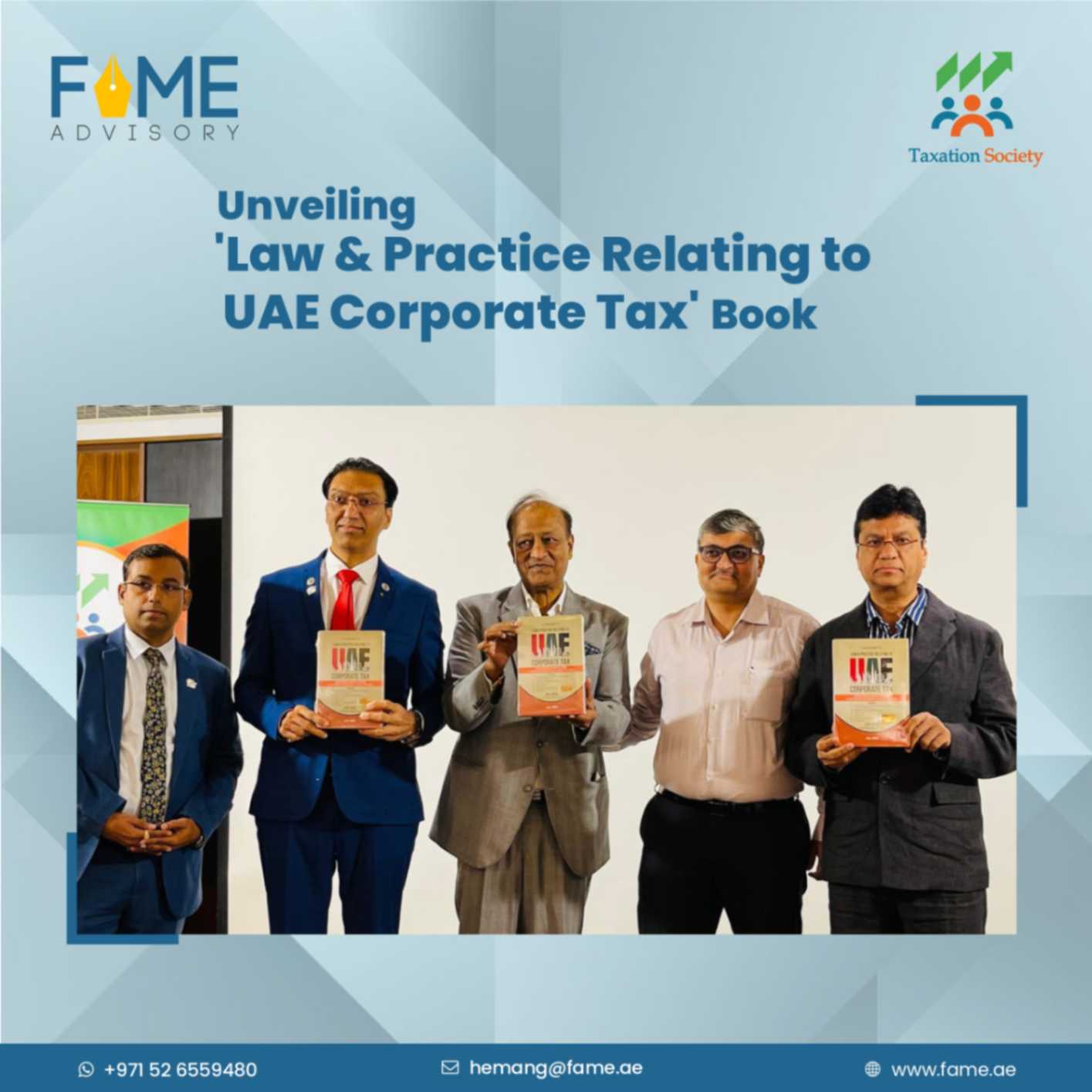

A standout moment of the event was the launch of “Taxmann’s Law & Practice Relating to UAE Corporate Tax (July 2024 edition)“, a comprehensive guide written by our Director, CA Nirav Shah.

This new edition offers in-depth analysis and up-to-date information on the intricacies of the UAE’s corporate tax landscape, designed to support professionals and businesses in navigating the complexities of the evolving tax environment.

The event also featured distinguished speakers, including Shri Mukesh Vora, who shared their expert views on the latest updates in corporate tax policies and Emiratisation laws. Their contributions sparked meaningful discussions on how these changes impact businesses and professionals in the UAE.

In addition to the enlightening talks, the evening provided a fantastic opportunity for networking, allowing attendees to connect with fellow experts and exchange ideas about the future of taxation and business in the region.

We would like to extend our heartfelt thanks to everyone who attended the event, our generous sponsors whose support made the evening possible, and the dedicated members of the Taxation Society who worked tirelessly to bring this event to life. Your contributions made this event a resounding success.

For those looking to stay ahead in the world of UAE corporate tax, we encourage you to grab a copy of Taxmann’s Law & Practice Relating to UAE Corporate Tax (July 2024 edition). This essential resource will equip you with the knowledge you need to navigate the dynamic tax landscape in the UAE.

We look forward to seeing you at our future events as we continue to explore and discuss the latest developments in the UAE taxation space.