Corporate Tax Registration

- Assistance in gathering and preparing the documents requirements

- Submission of corporate tax registration applications and advisory regarding tax obligations

Corporate Tax Return Filing

- Accurate tax filing by carefully organizing and compiling the financial data

- Preparing and submitting the CT return as per the latest tax laws

Tax Residency Certificate

- Assistance in document preparation and application submission

- Thorough support to client throughout the verification procedure

CT Compliance and Reporting

- Ensure filing accurate and timely tax returns.

- Comprehensive tax reporting to keep proper track.

Tax Clearance Certificate

- We have your back during the application processing for tax clearance certificate

- Support for obtaining approval and allowing clients to stay compliant

Transfer Pricing

- Ensure that your business complies with international standards.

- Comply with cross-border transactions and conduct proper reporting.

Corporate Tax Representation and Litigation Support

- Offering legal representation for CT-related matters such as disputes and negotiations.

- Developing and implementing strategies to ensure effective resolution to CT-related matters.

Corporate Tax Impact Assessment

- Build a financial model to understand the impact of the new tax standards

- Performing scenario analysis for different outcomes based on different CT strategies

Corporate Tax Services for Every Business

Do the Corporate Tax Laws and Regulations sound confusing to you? Do you need a helping hand so that you can focus on your business?

Be it corporate tax registration, accounting, training, return filing, or other compliances, FAME is by your side! Let's set up a system where we have a defined procedure to handle business transactions, tax concerns and record keeping. Let's make corporate tax compliance a stress-free ride!

Corporate Tax Registration

• Submission of corporate tax registration applications and advisory regarding tax obligations

Corporate Tax Return Filing

• Preparing and submitting the CT return as per the latest tax laws

Tax Residency Certificate

• Thorough support to client throughout the verification procedure

CT Compliance and Reporting

• Comprehensive tax reporting to keep proper track.

Tax Clearance Certificate

• Support for obtaining approval and allowing clients to stay compliant

Transfer Pricing

• Comply with cross-border transactions and conduct proper reporting.

Corporate Tax Representation and Litigation Support

• Developing and implementing strategies to ensure effective resolution to CT-related matters.

Corporate Tax Impact Assessment

• Performing scenario analysis for different outcomes based on different CT strategies

Reimagine Corporate Tax Compliance

Revolutionize your approach to corporate tax. Our tax advisory services help you rise above compliance challenges.

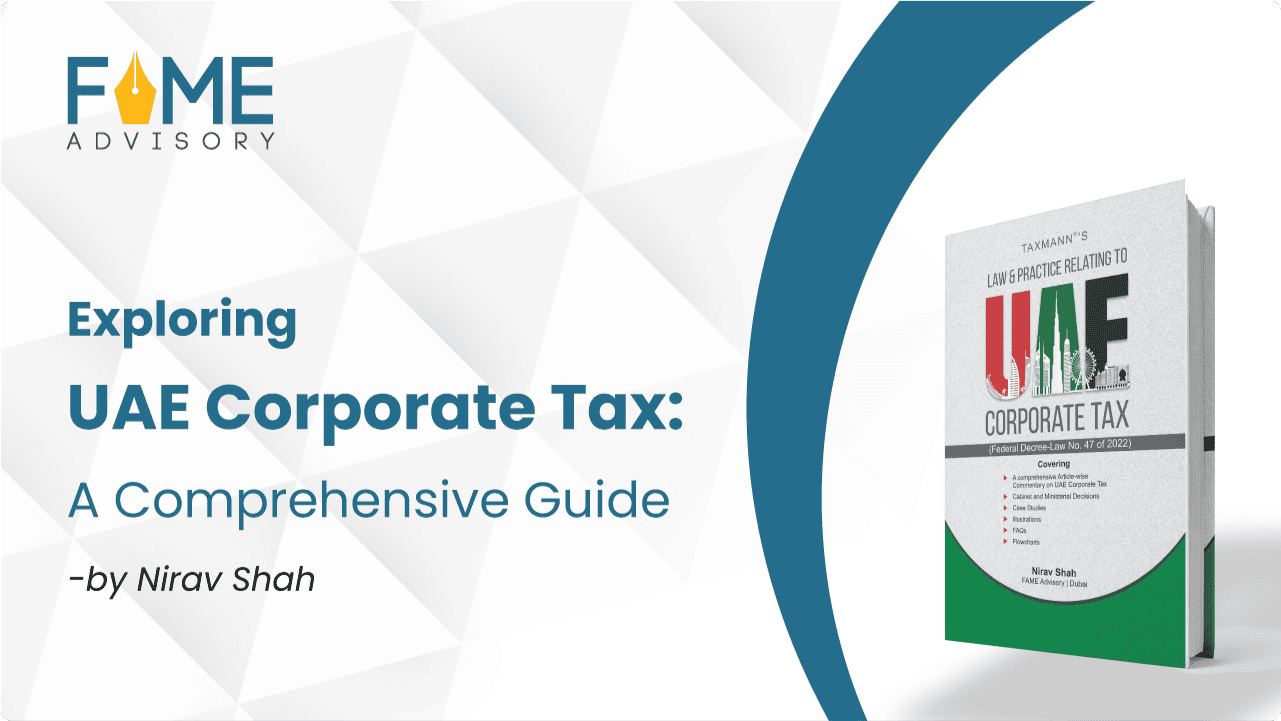

Taxmann’s Law & Practice Relating to UAE Corporate Tax

- By Nirav Shah

Created to help you stay ahead in the dynamic landscape of UAE Corporate Tax

- Corporate Tax (CT) is a direct tax levied on the net income or profit of corporations and other businesses. CT is also referred to as “Corporate Income Tax” or “Business Profits Tax” in other jurisdictions.

- Corporate Tax (CT) is a direct tax levied on the net income or profit of corporations and other businesses. CT is also referred to as “Corporate Income Tax” or “Business Profits Tax” in other jurisdictions.

Is it compulsory to register for corporate tax in UAE?

Is it compulsory to register for corporate tax in UAE?

Step 6 : Review & Declaration

Step 6 : Review & Declaration

Step 1 : Create an account

Step 1 : Create an account

Test

Test

Test

Understanding the Basics of Corporate Tax in UAE

Understanding the Basics of Corporate Tax in UAE

Understanding the Basics of Corporate Tax in UAE

Who should register for Corporate Tax?

Who should register for Corporate Tax?

Is it compulsory to register for corporate tax in UAE?

Who should register for Corporate Tax?

Step 6 : Review & Declaration

Step 1 : Create an account

With three decades of market presence, FAME Advisory has remained the UAE’s most trusted Advisory firm to serve and assist clients with a holistic and cross-disciplinary combination of market-leading advisory, financial resource management, and a regulatory & compliance services practice, all through one single platform.

With three decades of market presence, FAME Advisory has remained the UAE’s most trusted Advisory firm to serve and assist clients with a holistic and cross-disciplinary combination of market-leading advisory, financial resource management, and a regulatory & compliance services practice, all through one single platform.

With three decades of market presence, FAME Advisory has remained the UAE’s most trusted Advisory firm to serve and assist clients with a holistic and cross-disciplinary combination of market-leading advisory, financial resource management, and a regulatory & compliance services practice, all through one single platform.