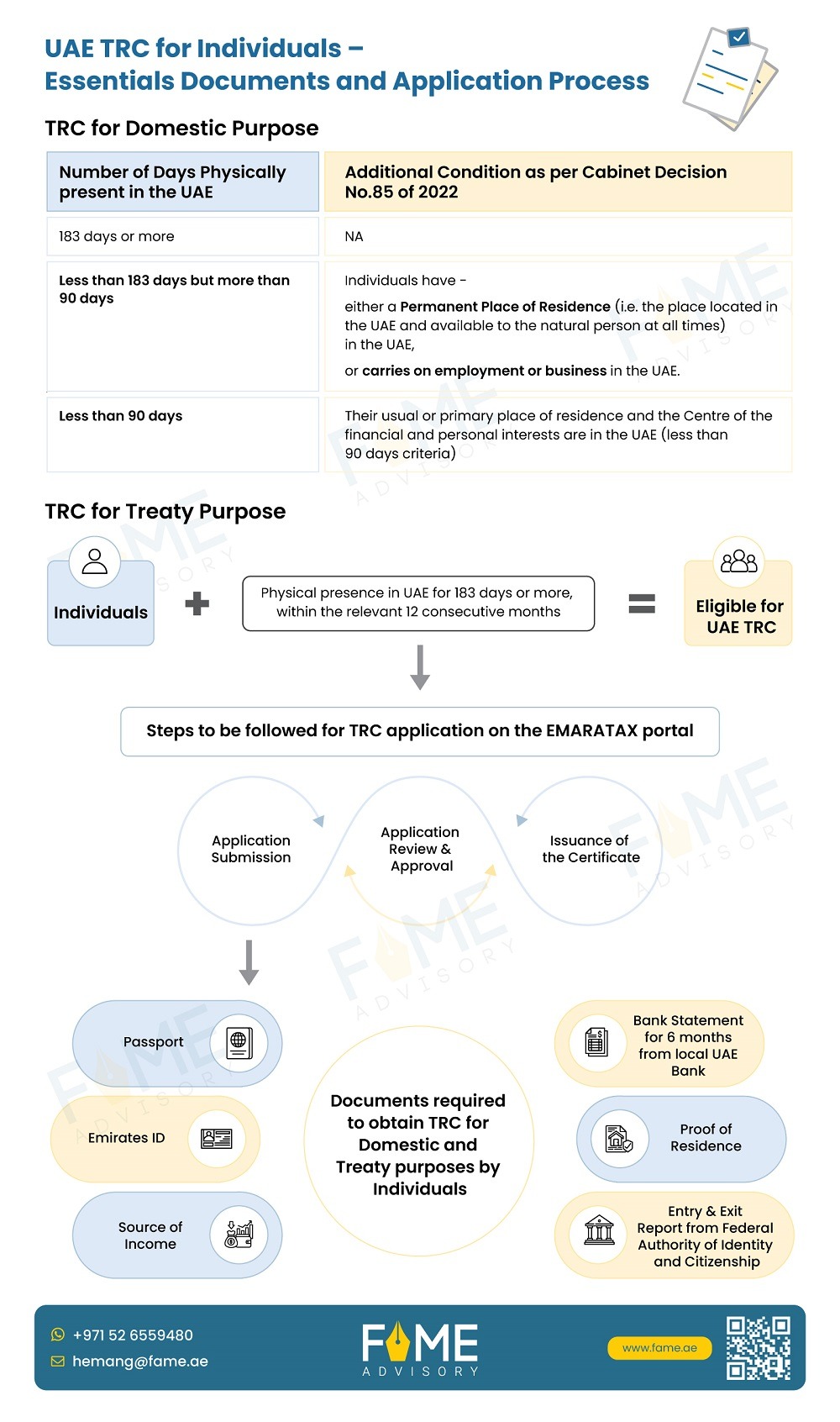

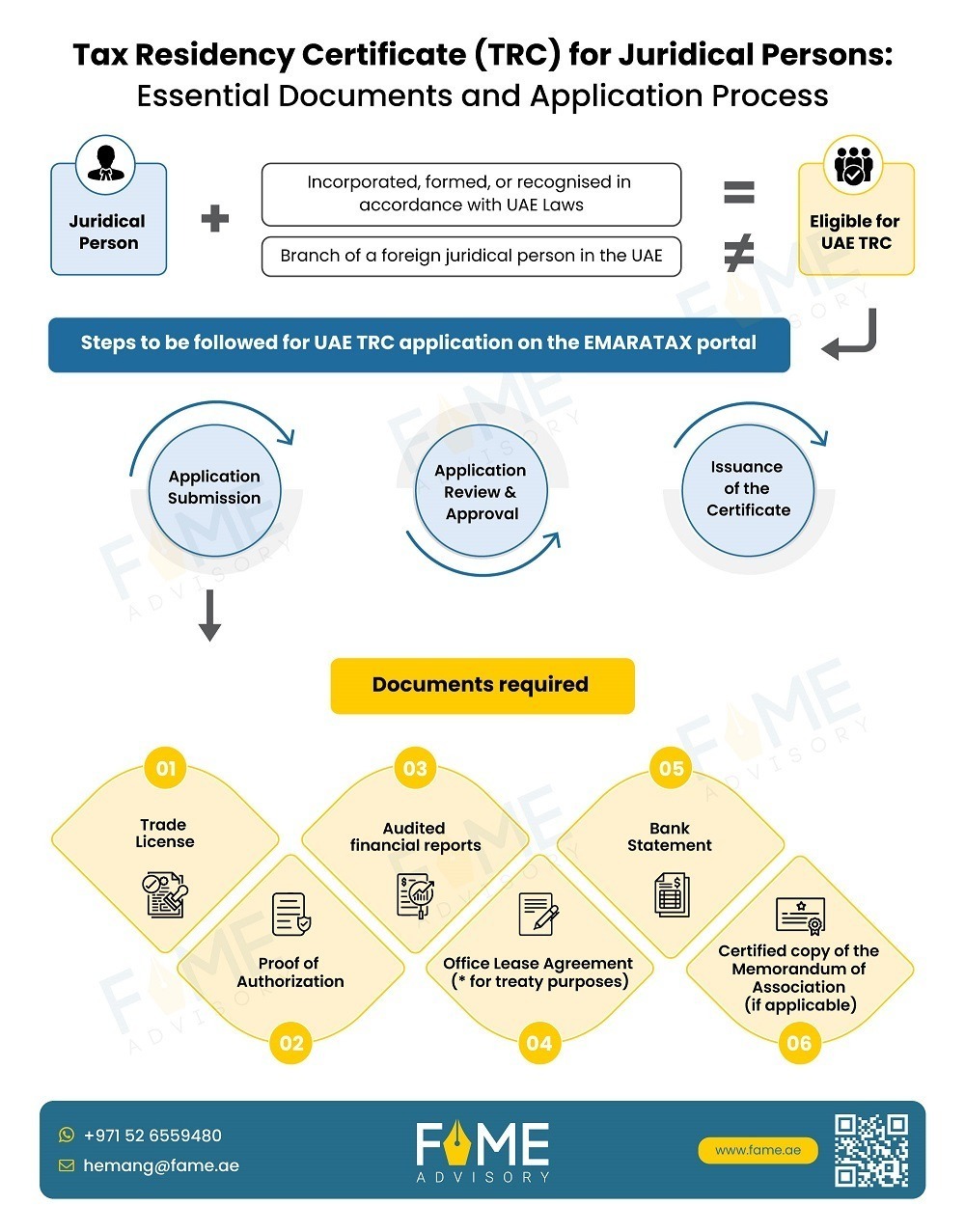

The Infographic gives a concise overview of the steps and documents required for a Juridical Person to obtain TRC in UAE for domestic and tax treaty purposes.

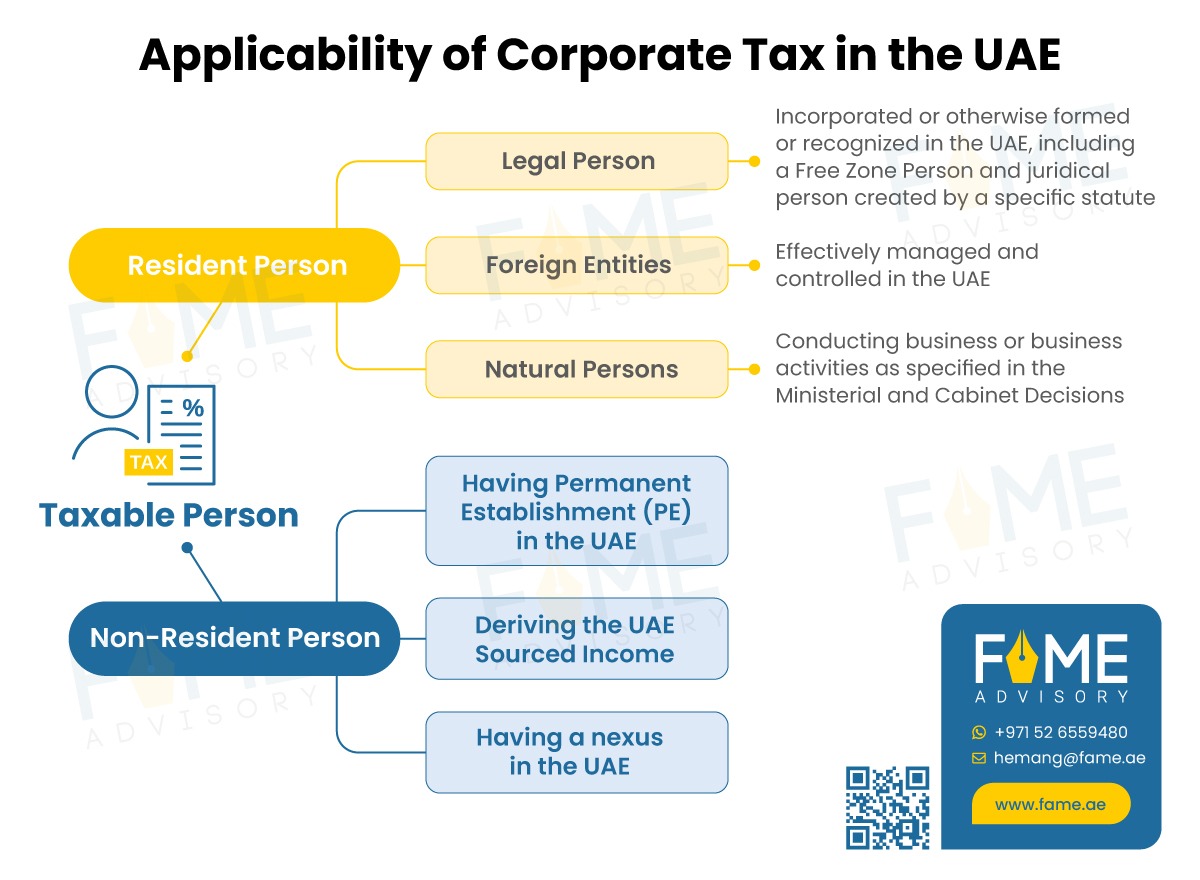

The taxable persons subject to UAE Corporate Tax are:

Why Tax Residency Certificate (TRC) is essential for Juridical Persons?

- establish their tax residency status,

- fulfil other tax obligations and regulatory requirements, or

- Avail the benefit of Double Tax Avoidance Agreements to avoid paying double taxes, i.e., paying tax twice on the same source of income in two or more countries.

TRC for Juridical Person in UAE: Eligibility Criteria

A Juridical Person is eligible for TRC in UAE only when it is established, formed, or recognized under UAE laws for at least a year. However, offshore companies are not eligible to obtain the TRC.

Steps for a Juridical Person to Obtain TRC

A Juridical Person can apply online for UAE TRC by registering on the Federal Tax Authority’s (FTA) EMARATAX portal.

After successful registration, the Juridical Person must:

- Select the application type, start date of the required financial year and preferred language for TRC.

- Fill out the details requested in the application form and attach the necessary documents to obtain the TRC.

The Information to be filled out in the application form by the juridical person includes:

1. Name of the Entity in English and Arabic

2. Authority issuing Trade License

3. Trade License Number and its Expiry Date

4. VAT & Excise TRN

Documents that Juridical Person Requires for Getting TRC

The documents to be uploaded include the following:

1. Trade License

2. Proof of Authorization (Establishment Contract or the Power of Attorney)

3. Copy of the audited financial report (The financial audit report must cover the same requested start date of the financial year in the application or the year before).

4. Office Lease agreement/tenancy contract. (*only when applying for TRC for treaty purposes)

5. A bank statement issued by a local bank covering 6 months within the financial year related to the request.

6. Certified copy of the Memorandum of Association (if applicable)

7. If a Special Form is required, the applicant can either upload a scanned copy or provide the original document for signing.

Submission of TRC Application

Upon receipt of the TRC application form and the corresponding documents, the tax authorities will review the application.

The tax authorities may request additional information or documents if required. When the application is complete in all respects, authorities will issue the Tax Residency Certificate.