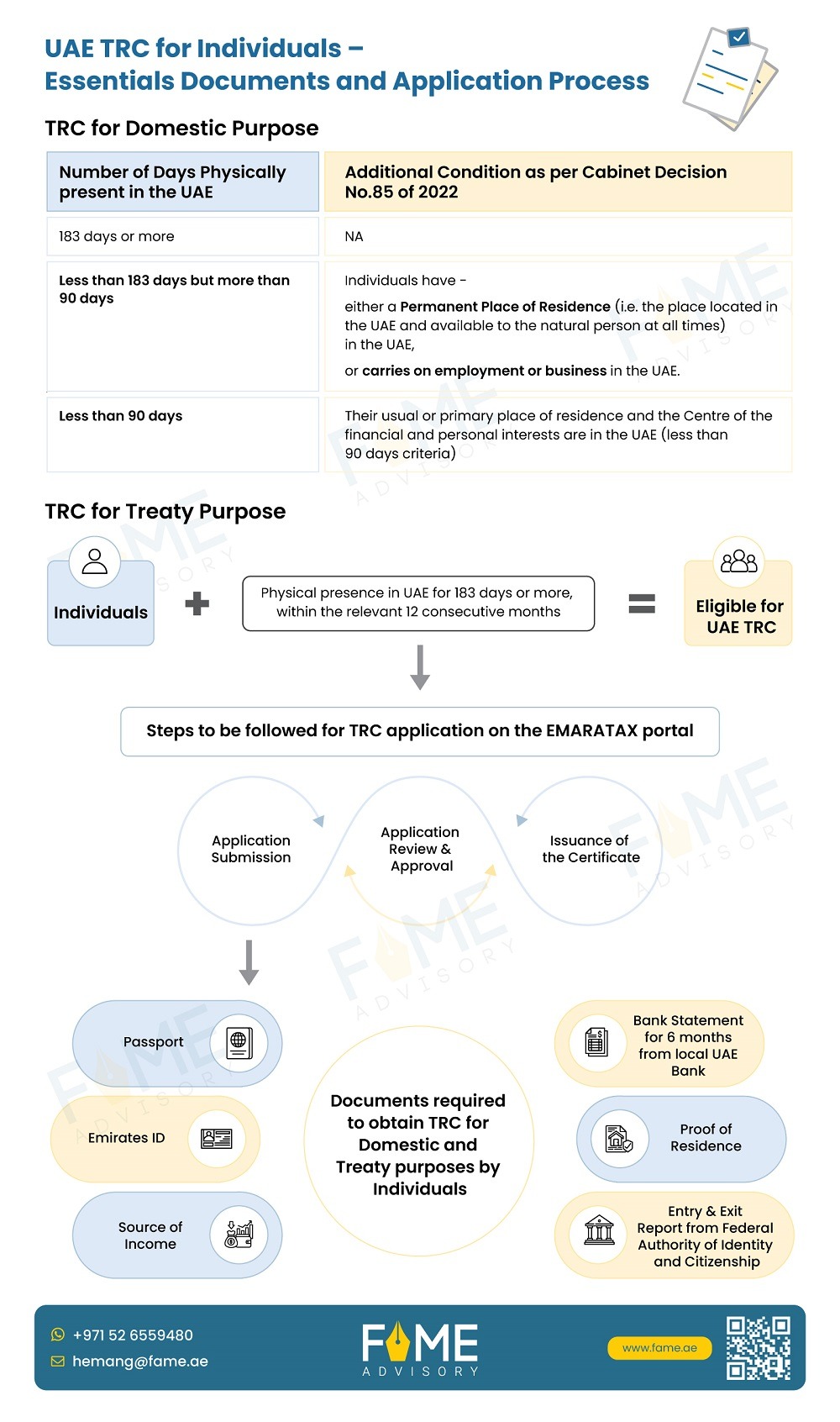

UAE TRC for individuals is essential for individuals to establish their tax residency status, fulfil other regulatory requirements, and avoid paying double taxes, i.e., paying tax twice on the same income in UAE and any other country, forming part of a tax treaty alliance.

Conditions for Obtaining UAE Tax Residency Certificate for Individuals

- An Individual applying for TRC for Treaty Purpose in the UAE, must have been residing in the UAE for at least 183 days during the requested financial year.

- An Individual applying for TRC for Domestic Purposes can be eligible – if it falls under any of the three conditions as per Cabinet Decision no. 85 of 2022 –

- Spent in UAE – at least 183 days

- Spent in UAE – Less than 183 days but above 90 days

- Spent in UAE – less than 90 days

Let us have a quick overview of the conditions laid down in cabinet decision no. 85 of 2022, which will apply for individuals based on their number of days of stay as listed above:

As per cabinet decision no.85 of 2022, Individuals can obtain TRC for domestic purpose, if

- The Individual has been physically present in the State (UAE) for a period of (183) one hundred and eighty-three days or more, within the relevant (12) twelve consecutive months ; (183 days criteria) (No additional condition to be fulfilled) OR

- Any Individual (being a UAE National or a GCC National or UAE Resident) has been physically present in the UAE for a period of 90 days or more, within the relevant 12 consecutive months and has either a Permanent Place of Residence (i.e. the place located in the UAE and available to the natural person at all times) in the UAE or carries on employment or business in the UAE. (Less than 183 days but above 90 days criteria. OR

- Their usual or primary place of residence and the centre of the financial and personal interests are in the UAE (less than 90 days criteria)

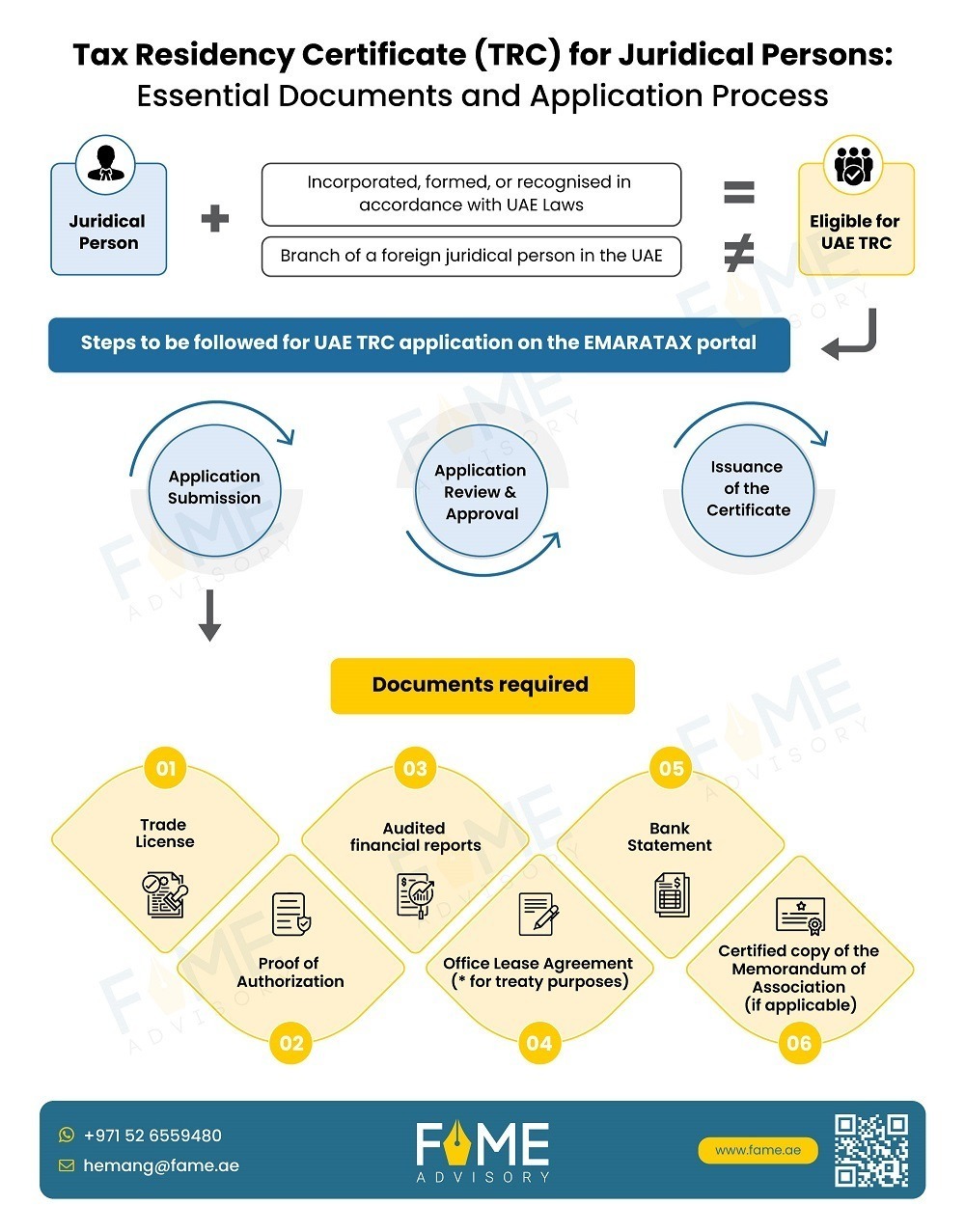

Now, let us see how to make application for TRC –

A Resident Individual can apply online by registering on the Federal Tax Authority’s (FTA) EMARATAX portal.

After successful registration, follow the steps below:

- Select the application type, start date of the required financial year and preferred language for TRC.

- Fill out the details requested in the application form and attach the necessary documents to obtain the TRC.

What’s New in the UAE TRC for individuals?

The portal now allows the applicant to select the Number of Physical copies of TRC required which can be selected at the time of making application as well as after making the application.

Documents Required for Obtaining UAE TRC for Individuals

- Passport

- Emirates ID

- Source of Income/Salary Certificate:

- Self-employed individuals can provide a trade license and share certificate.

- The UAE national, if earning rental income from a property, can provide a lease agreement if the property is leased.

- If the UAE national is retired, provide a letter addressed to the FTA stating that they are using their own savings, bonds, or investments. Additionally, provide an official supporting document.

- Validated bank statements of 6 months from a local UAE bank for the financial year for which TRC is being requested.

- Proof of residence (e.g., Lease agreement, Tenancy Contract, EJARI, Utility Bill)

- Entry and Exit report from the Federal Authority of Identity and Citizenship.

- If a Special Form is required, the applicant can either upload a scanned copy or provide the original document for signing.

Payment and Application Submission

The applicant, prior to submission, must review, confirm, and make payment of the submission fee and submit the TRC application.

Upon receipt of the TRC application form and the corresponding documents, the tax authorities will review the application. The tax authorities may request additional information or documents if required.

When the application is complete in all respects, the FTA will issue the Tax Residency Certificate at the address chosen by the applicant for receipt of the same.