- April 8, 2024

Corporate Tax Registration on EmaraTax: The Complete Guide is a comprehensive look at the legal requirements related to corporate tax registration, documents required, procedures to follow, and mistakes to avoid. Read the article for a step-by-step guide for Corporate Tax Registration on the EmaraTax portal.

Understanding the Basics of Corporate Tax in UAE

- Corporate Tax (CT) is a direct tax levied on the net income or profit of corporations and other businesses. CT is also referred to as “Corporate Income Tax” or “Business Profits Tax” in other jurisdictions.

- A competitive CT regime based on international best practices is expected to cement the UAE’s position as a leading global hub for business and investment and accelerate the UAE’s development and transformation to achieve its strategic objectives. The introduction of a CT regime also reaffirms the UAE’s commitment to meeting international standards for tax transparency and preventing harmful tax practices.

- The UAE CT regime has become effective for financial years starting on or after 1 June 2023.

Examples:

- A business with a financial year starting on 1 July 2023 and ending on 30 June 2024 will become subject to UAE CT from 1 July 2023 (the beginning of the first financial year starting on or after 1 June 2023).

- A business with a financial year starting on 1 January 2023 and ending on 31 December 2023 will become subject to UAE CT from 1 January 2024 (the beginning of the first financial year starting on or after 1 June 2023).

Who should register for Corporate Tax?

Every taxable person, including Free Zone Persons, must register with the Federal Tax Authority (FTA) under the CT Law regime. Every person carrying out business or business activities in the UAE under the license must obtain a tax registration number.

Timeline for Corporate Tax Registration

All the Taxable persons must register under the Corporate Tax regime as per the timeline prescribed by FTA via decision no.3 of 2024.

Corporate Tax Registration Timeline for Taxable Persons: FTA Decision No-3 of 2024

On 28 February 2024, Federal Tax Authority (FTA) has released decision no.3 of 2024 stating the Timeline for Registration of Taxable Persons for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments. The key highlights of the decisions are outlined below:-

CT Registration Timeline: Key points to be taken into consideration

- Effective date of this Decision is March 1, 2024.

- In our view, first issue month (Original Issuance date mentioned in the Trade License) is to be considered for determining the deadline for CT registration.

- The earliest Deadline for submission is 31 May 2024 for the companies that have January or February as the license issue month.

- Penalty of AED 10,000 will be imposed on non-submission of Corporate Tax Registration application rather than on obtaining Corporate Tax Registration Number from Emara Tax Portal.

Timeline for CT Registration application submission on Emara tax portal

1. A Timeline for Tax Registration of Resident Juridical Persons that are incorporated or established or recognised before March 1, 2024 are: –

Month of Issue of License irrespective of year of issuance of license Deadline for Submitting a Tax Registration application 1 January - 31 January 31 May 2024 1 February - 28/29 February 31 May 2024 1 March - 31 March 30 June 2024 1 April - 30 April 30 June 2024 1 May – 31 May 31 July 2024 1 June - 30 June 31 August 2024 1 July – 31 July 30 September 2024 1 August – 31 August 31 October 2024 1 September – 30 September 31 October 2024 1 October – 31 October 30 November 2024 1 November – 30 November 30 November 2024 1 December – 31 December 31 December 2024 If a person does not have a license on March 1, 2024 3 Months from 1 March 2024 (i.e., before the end of May 2024)

For resident Juridical person that have more than one license, in such case the license that was issued earliest shall be considered.

2. Timeline for Tax Registration of Resident Juridical Persons that are incorporated or established or recognised on or after March 1, 2024: –

Category of juridical persons Deadline for Submitting a Tax Registration application A person that is incorporated or established or recognised under the applicable legislation in the State, including a Free Zone Person. 3 months from the date of incorporation, establishment or recognition. A person that is incorporated or established or recognised under the applicable legislation of a foreign jurisdiction that is effectively managed and controlled in the UAE. 3 months from the end of the Financial Year of the person.

3. Timeline for Tax Registration of Non-Resident Juridical Persons: –

- Became non-resident taxpayer before 1 March 2024:

- A person that has a Permanent establishment in UAE: must register within 9 months from the date the permanent establishment came into existence.

- A person that has Nexus in the UAE: must register within 3 months from 1 March 2024 (i.e. before the end of May 2024).

- Became non-resident taxpayer on or after 1 March 2024:

- A person that has a Permanent establishment in UAE: must register within 6 months from the date the permanent establishment comes into existence.

- A person that has Nexus in the UAE: must register within 3 months from the date the nexus was established.

4. Timeline for Tax Registration of Natural Persons:

- Resident Natural Persons whose total turnover exceeds AED 1 Mn in a Gregorian calendar year (January-December): before31 March of the subsequent Gregorian year

- Non-residents Natural Person conducting a Business or Business Activity during the 2024 Gregorian calendar year or subsequent years whose total Turnover derived in a Gregorian calendar year exceeds AED 1 Mn: within 3 months from the date the individual became a UAE taxpayer.

5. An administrative penalty of Dh10,000 will be imposed for late registration of UAE Corporate Tax. This penalty is applicable to businesses that fail to submit their Corporate Tax registration applications within the aforementioned timelines set by the FTA.

What is the EmaraTax Platform?

EmaraTax Platform is the Official website managed by the FTA (Federal Tax Authority of the UAE) that offers various digital services to UAE Businesses. The services include handling Tax Registration, Filing of Returns, Payment of Taxes and Applying for tax refunds under the UAE CT Law regime. Read further to know how to register for corporate tax in UAE.

What are the Documents Required for Corporate Tax Registration on EmaraTax?

Documents required for CT Registration on EmaraTax Portal:

- Certificate of Incorporation and Copy of all the latest Trade licenses.

- Copy of Memorandum of Association & Articles of Association / Partnership Agreement or any other document showing ownership information about the business.

- Registered office address.

- Financial Year adopted by a Taxable person to prepare financial statements.

- Copy of the latest Emirates ID and Passport of the Owners/shareholders, along with details of their shareholding in the business.

What are the Steps for Corporate Tax Registration on EmaraTax?

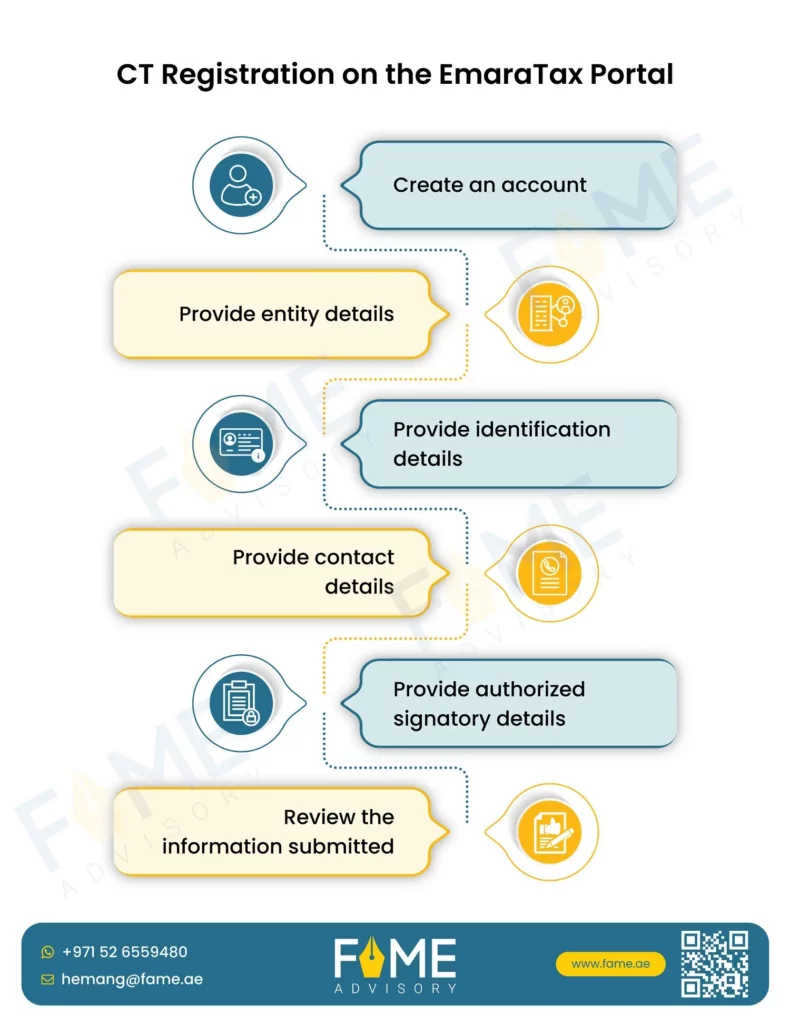

Steps to apply for CT Registration on the EmaraTax Portal:

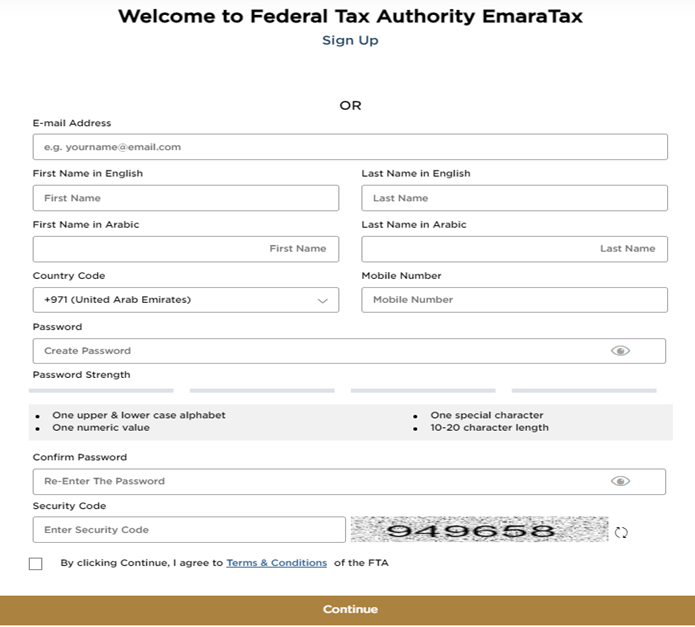

Step 1 : Create an account / EMARA Tax Login

Create an account on the EmaraTax portal by registering with your email ID and Phone number or logging in using your existing ID and password.

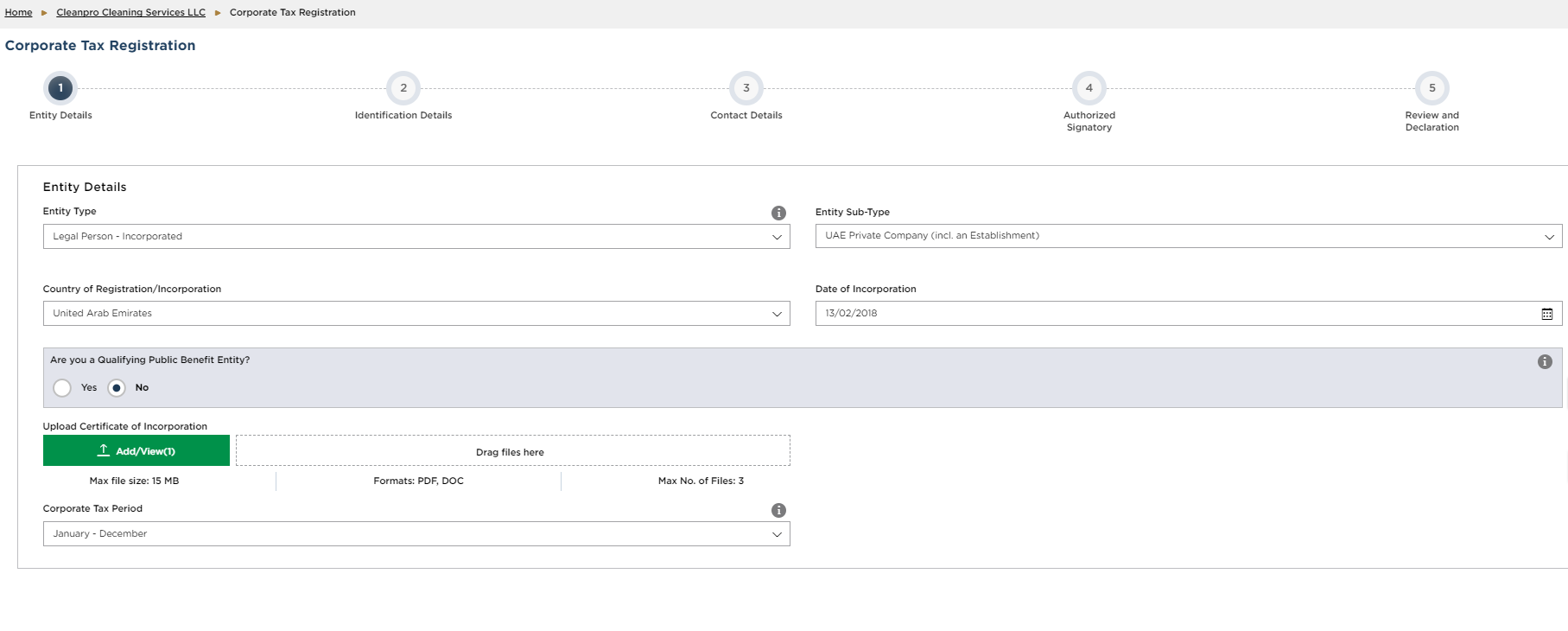

Step 2 : Entity Details Section

1. Select the appropriate option for Entity Type and Entity Sub Type.

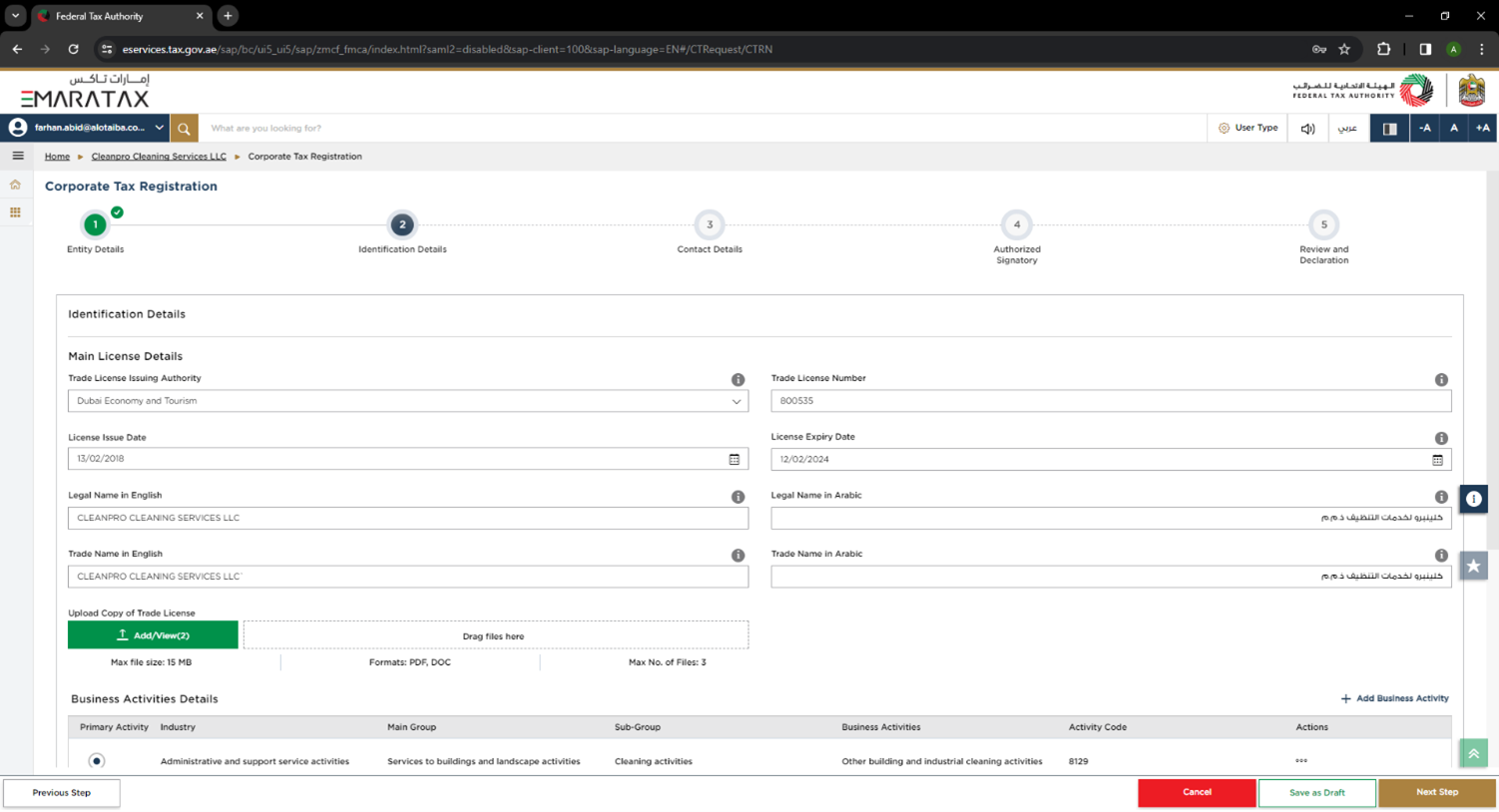

Step 3 : Identification Details

1. Depending on the ‘Entity Type’ selected, you must provide the main trade license details in the identification details section.

2. Click ‘Add Business Activities’ to enter all the business activity information associated with the trade license.

3. Enter the mandatory business activity information and click on Add.

4. Click on ‘Add Owners’ to enter all the owners that have 25% or more ownership in the entity being registered.

5. Select ‘Yes’ if you have one or more branches, and add the local branch details.

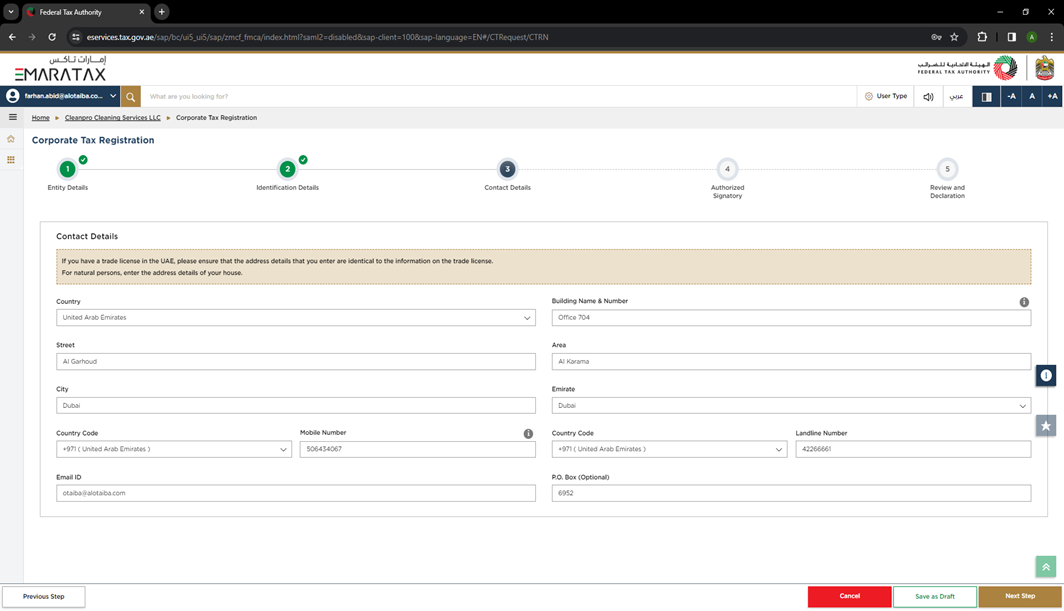

Step 4 : Contact Details

1. Enter the registered address details of the business.

2. Do not use another company’s address (for example, your accountant). If you have multiple addresses, provide details of the place where most of the day-to-day activities of the business are carried out.

3. If you are a foreign business applying to register for UAE CT, you may choose to appoint a tax agent in the UAE. In such cases, provide the necessary details.

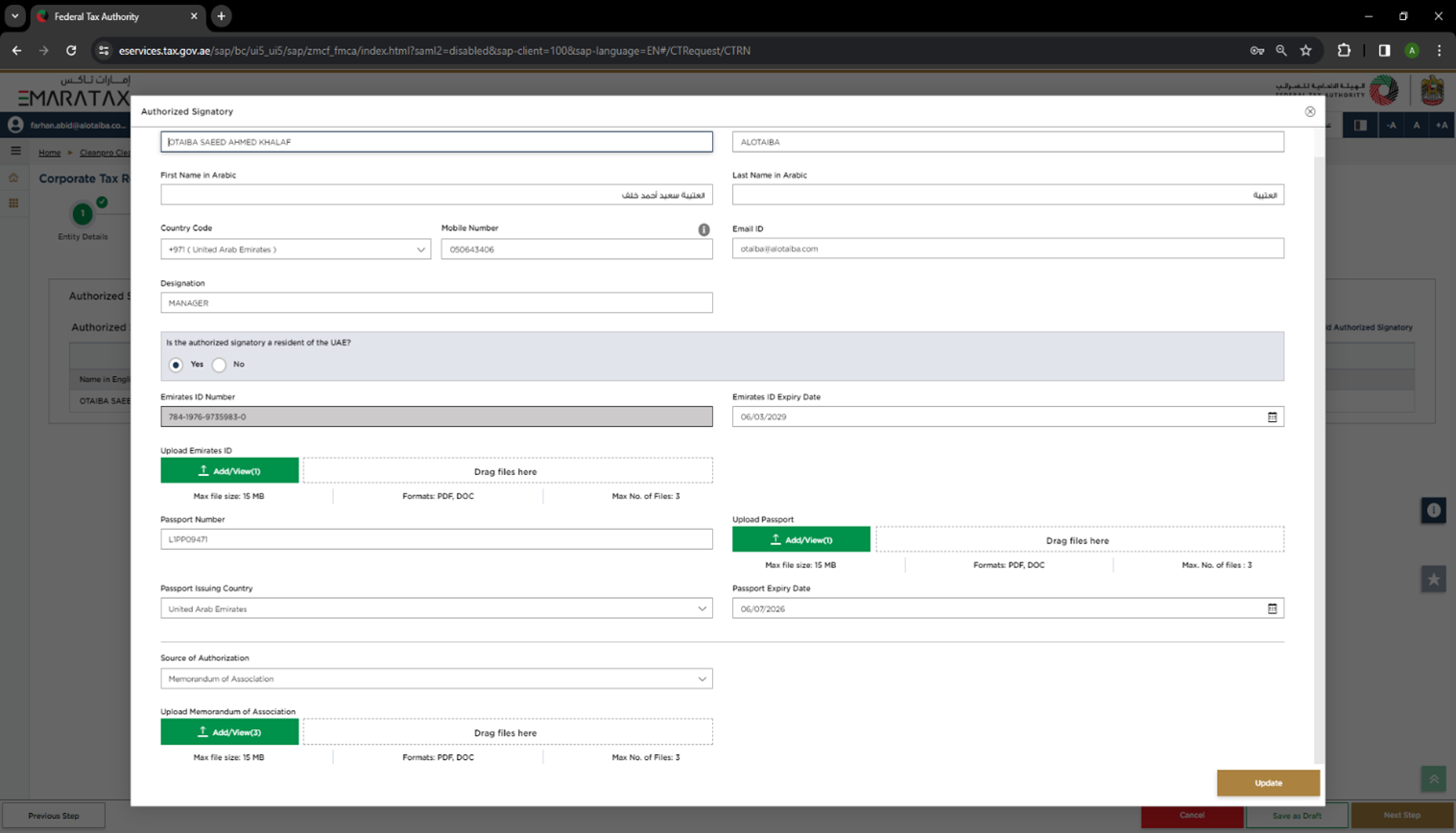

Step 5 : Authorized Signatory

1. Click ‘Add Authorized Signatory’ to enter the Authorized Signatory details.

2. Evidence of authorisation may include a Power of Attorney or Memorandum of Association for legal persons.

Step 6 : Review & Declaration

1. This section highlights all the details you entered across the application. You are requested to review and submit the application formally.

2. After submitting your application successfully, a Reference Number is generated for your submitted application. Note this reference number for future communication with FTA.

Other Important Aspects:

Registration of Entity with foreign Corporate Shareholder under UAE CT Law Regime:

In CT application, under owner details tab, while mentioning details for corporate shareholders which is a foreign entity, the drop down does not contain any option for foreign trade license issuing authority. As a result, being a mandatory field, UAE trade licensing authority of registrant entity has to be selected in order to proceed to the next step of CT application

What are the Mistakes to Avoid During UAE Corporate Tax Registration on EmaraTax?

Incomplete Documentation:

It is to be ensured that the documents submitted support the information you entered in the application. This would help to avoid any rejection or resubmission of the application later.

Expired Documents:

Please ensure all legal documents, such as the trade license, are current and not expired when submitting your application. Expired documents will delay processing, and FTA may raise queries accordingly.

Inappropriate Information:

The applicants are supposed to provide a ‘Date of Incorporation’ while applying for CT registration. Applicants commonly make a mistake to provide a Trade License Renewal date. However, here, it is expected to provide the Date of Incorporation of the entity. Such mistakes may lead to the rejection of the CT registration application by the FTA, UAE.

Selection of Options while applying for CT Registration with the FTA:

If the entity has selected entity Type as ‘Legal persons – Other' in VAT Registration, then at the time applying for CT Registration Application, Applicant cannot edit the Type of Entity and it will be auto populated as ‘Legal Persons-other'. And eventually such application are accepted by the FTA

Post-Registration Responsibilities and Compliance

Regular Tax Return Filing:

Article 53 ‘Tax Returns’ provides that every taxable person is liable to file a return of income online within 9 months from the end of the tax period or by any other such date as directed by the FTA. Information to be disclosed in the tax return:

It is mandatory for the taxable person to disclose the following information in the tax return:

- The tax period to which such tax return relates;

- The name, address, and tax registration number of the taxable person;

- Date of submission of the tax return;

- The accounting basis used in the financial statements;

- Taxable income for the tax period;

- Particulars of the brought forward loss;

- Particulars of the tax loss transferred and set off against the income of another taxable person;

- Particulars of withholding tax credit and foreign tax credit;

- Corporate tax payable for the tax period.

Exempt categories of persons are also needed to register under UAE CT Law and need to file a declaration with FTA for the same.

- The parent shall file the tax return for the ‘Tax Group.’

- The FTA may decide on the different forms and particulars to be submitted by different categories of the taxable person.

Due date to submit the tax return:

Return is to be filed within 9 months from the end of the relevant tax period or by such other date as may be decided by the FTA.

Audits and Assessments:

Audit & Accounts:

A taxable person with revenue exceeding AED 50,000,000 (fifty million dirhams) during the relevant tax period and a Qualifying Free Zone Person will be required to prepare and maintain Audited Financial Statements.

Taxable and exempt persons shall maintain all records and documents for a period of (7) seven years.

Assessments:

Once the taxpayer files the return of income, the next step is processing the return of income by the FTA. The FTA examines the return of income for its correctness, commonly referred to as ‘Assessment.

The FTA shall issue a tax assessment to determine the corporate tax payable, corporate tax refundable or any other matters as prescribed by the CT law and notify the taxable person within 10 business days of its issuance in any of the following cases:

1. The taxable person fails to apply for registration within the prescribed time frame;

2. The registrant fails to submit a tax return within the prescribed timeframe;

3. The taxable person fails to pay the payable tax as per the tax return submitted within 9 months from the end of the tax period;

4. The taxable person submits an incorrect tax return;

5. The registrant fails to calculate tax on behalf of another person when he is obligated to do so under the tax law;

6. There is a shortfall in the payment of tax as a result of a person evading tax or as a result of a tax evasion in which such person was involved;

7. Any other cases in accordance with the CT Law.

Penalties for Non-Compliance:

Administrative Penalties:

If the taxable person fails to submit a tax registration application within the prescribed time limit, then the administrative penalty would be as follows:-

Description of Violation | Administrative Penalty Amount in AED |

|---|---|

Failure of the Person Conducting a Business or Business Activity to keep required records and information as per the provisions of UAE Corporate Tax Law.

| One of the following penalties shall apply:

1. 10,000 for each violation OR 2. 20,000 for each repeated violation within 24 months from the date of the last violation. |

Failure of the Person Conducting a Business or Business Activity to submit the data, records and documents related to Tax in Arabic to the Authority when requested. | AED 5,000

|

Failure of the Taxable Person to submit a Tax Registration application within the timeframe specified by the authority in accordance with the Corporate Tax Law | AED 10,000

|

Seeking Professional Help for Tax Registration on Emara Tax

Hiring a tax consultant in the United Arab Emirates (UAE) to comply with the country’s Corporate Tax (CT) laws can offer multiple benefits. The following are a few advantages:

Smart Advice:

They know UAE tax rules inside out and talk to you like a friend, not a tax robot.

Custom Plans:

They make tax plans that fit your business like a glove—no generic stuff.

Time Saver:

They handle the tax fuss, giving you more time for your job.

No Fines, No Stress:

Keep up with deadlines, avoid fines, and wave goodbye to tax stress.

Audit Buddy:

If a tax audit happens, they’ve got your back. Less stress, more support.

Save Money, Not Spend:

Yeah, you pay them, but it’s an investment. Saves more than it costs.

Money Talk, Plain and Simple:

They explain how tax moves affect your money. No fancy talk, just straightforward advice.

Connections Beyond Tax:

Need more than tax help? They’ve got a network for legal and money matters.

So, a corporate tax consultant isn’t just an expense. It’s a wise move. They bring smarts, keep you in the tax game, and set you up for business success.

Conclusion:

The UAE government has introduced the Corporate Tax (CT) and positioned the country as a business and investment hub. It demonstrates the UAE authorities’ commitment to bringing transparency into business dealings. The introduction of corporate tax in the UAE will boost the economy and attract foreign direct investment.

Businesses in the UAE need to assess the applicability of the corporate tax law for their entities and establish sound record-keeping and compliance practices to comply with the legal requirements. The businesses need to train their staff and follow the updates and ministerial decisions issued by the UAE Federal Tax Authority. Make use of our corporate tax registration guide, be ready with documents required for corporate tax registration in UAE and comply with the CT registration requirements.

The Federal Tax Authority maintains the EmaraTax Portal. It provides a streamlined process for Corporate Tax Registration in the UAE.

Leave a Reply

Your email address will not be published. Required fields are marked *