- May 24, 2024

Under the Cabinet of Ministers Resolution number (57) of 2020 concerning Economic Substance Requirements and ministerial decision number (100) of 2020 to comply with the Economic Substance Regulation (ESR) you are under audit.

If you or your entity received ESR Audit notice from National Assessing Authority, this article comes handy as we cover primary factors that should be taken care of. You can also keep this article as your go-to resource for future reference.

What is an ESR Audit Notice?

Federal Tax Authority (FTA), being the National Assessing Authority, may undertake assessments to determine whether a Licensee has met the Economic substance Test or not. FTA can either send additional Information request or issue audit Notice in this regard.

As per the Economic Substance Regulation, UAE entities whose business activities meet the scope and definition of any of the nine relevant activities, are required to prepare and submit Economic substance Notification and Economic Substance Report.

Relevant Activities Under ESR Law

- Banking Business

- Insurance Business

- Investment Fund management Business

- Lease – Finance Business

- Headquarters Business

- Shipping Business

- Holding Company Business

- Intellectual property Business (“IP”)

- Distribution and Service Center Business

Such reporting entities are Licensees for ESR law.

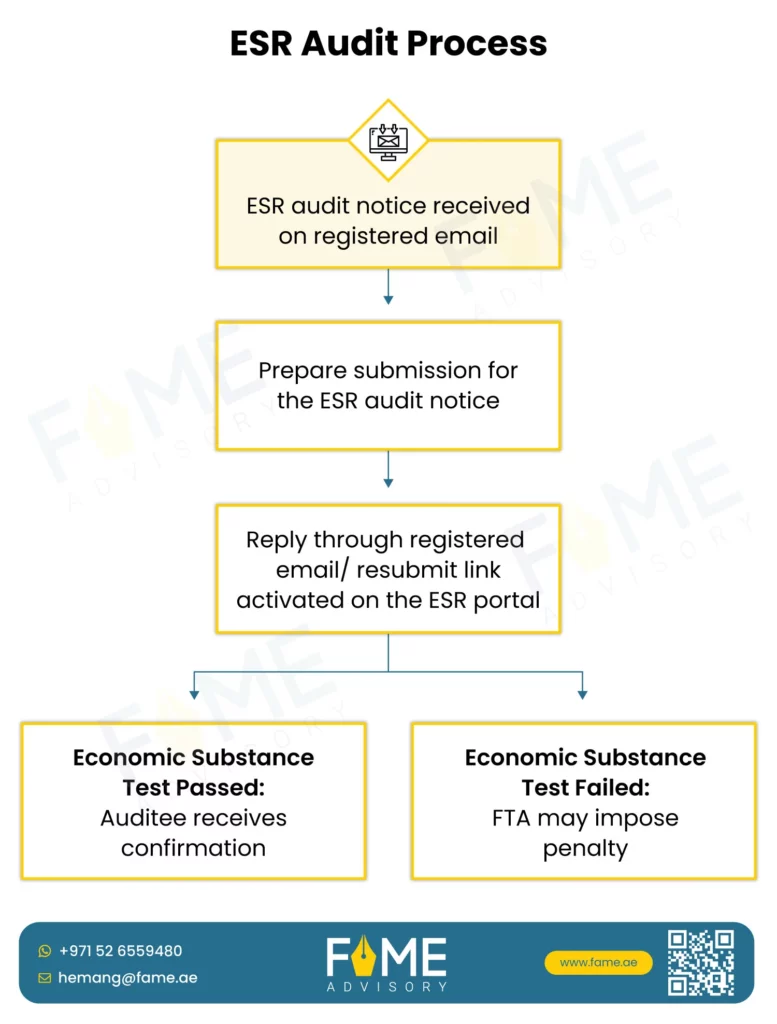

How is the ESR Audit notice issued?

Licensee (Being a UAE Business entity) subject to ESR Audit will be sent intimation either on the registered email or resubmit link will be activated on the ESR Portal or both. The Tax Auditor from Federal Tax Authority will send email to the registered email address indicating the submission requirements.

For ESR Audit licensee will get ‘you are under audit’ email from the tax auditor of Federal Tax Authority. The email notifies about the entity under audit, List of requirements to be submitted and time frame or submission deadline. Usually, FTA gives 5 business days from the date of Audit Notification for submitting the Audit Response.

One may also get additional Information request from their License issuing Authorities, with regards to the ESN or ESR submitted, where in an information for supporting your submissions may be assessed.

What are the details asked under ESR Audit Notice?

One of the most common ESR audit challenges that licensees have is the detailed asked under the ESR audit.

The ESR Audit intimation usually comes with a File name - Initial List of requirements. It has standard set of questions and requirements.

There is an exhaustive list that requires you to submit large amount of information with the deadline of five business days.

To make it easy for you to understand the complete list, we have categorized the information requested under ESR audit:

- Company related general documents – Trade License, Lease agreement

- Constitutional documents – Memorandum of Association, UBO declaration

- Employee Details – CVs, Timesheets, Employee Contracts, Passport, Visa and Emirates ID of the Employees, working papers for calculation of Full Time Employees.

- Financial Information – Audited Financials/Management Accounts, Working Papers for calculation of Relevant Income, Profit/Loss attributable to the relevant activity

- Relevant Activity Information – Clarification for type of Relevant Activity reported and justification as to how business activity meets the Relevant Activity criteria.

- Assets details – Details of Physical assets held in UAE, Lease Agreements, Title Deeds/purchase agreements of the assets

- Boar Meetings – The questions relating to number of board meetings held within UAE and Outside UAE, Number of resident directors present, details of resident directors and non-resident directors, explanations in case no meetings were held during the reporting year

- Outsourcing Information – If the main activity of the business is outsourced, all the information related to Outsourced activity, Entity to whom activities are outsourced and other related information

You can use this as ESR audit preparation checklist for documents. Overall, the list has more than 30 items which includes questions and documentary evidence. In substance, everything asked revolves around the submissions done at the time of Filing your Economic Substance Notification and Economic Substance Report. Therefore, don’t get anxious looking at the long list of requirements. Yes, you are mostly prepared at the submission stage and in the Audit stage, you only need to organize and present your documents and justification.

How to Submit ESR Audit Response?

Tax Auditor of Federal Tax Authority can ask you to submit the information in the following ways:

Email Response - Reply to the email received from the FTA Tax Auditor with the response letter and all the documents and working files prepared.

ESR Portal Response – If the Audit Intimation email says – click on the link to submit your response – you have been asked to submit Audit Response on ESR portal through your dashboard. Click on the link, Login and you will find resubmit link against the Financial Year column for which Audit has been initiated.

How will I know if the Information provided would suffice?

After the review of your submissions, the FTA will ensure it has received all the information it requires to conduct the audit. So, you may receive the request (on registered email address) to resubmit some information or submit additional information. But if no such email comes after your submission – You have done it all right, as far as submission of response is concerned.

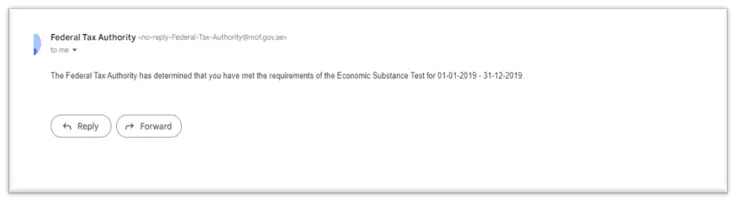

ESR Audit Conclusion

So long as the working papers, relevant activity information and the documents of the company can evidence that your entity meets the Economic substance Test, the Audit will conclude, and the Auditee receives confirmation as below –

the National Assessing Authority determines that a Licensee or an Exempted Licensee has failed to comply with applicable provisions of the ESR Regulations, the National Assessing Authority may impose various administrative penalties as set out under ESR Regulations.

What are the important aspects to be considered for ESR Audit?

- Note that, FTA is assessing whether Reporting entity meets the Economic substance Test or not? Here are the key requirements of Economic substance Test

- The Licensee conducts Core Income-Generating Activities (“CIGA”) in the UAE.

- The Relevant Activity is directed and managed in the UAE;

- Having regard to the level of Relevant Income earned from a Relevant Activity, has an:

- i) adequate number of qualified full-time (or equivalent) employees in relation to the activity,

- ii) incurs adequate operating expenditure by it in the UAE

- iii) has adequate physical assets (e.g. premises) in the UAE.

- Verify the details submitted in the Economic Substance Report and ensure that all the information submitted therein is same as the Audit Response you will be submitting.

- Arrange the documents and mark them in the same series in which they are asked in the Initial Requirement List – this will ensure that no document or information is missed out.

- All the explanations and working papers should be provided in separate files and keep the file names in context of the information asked. For instance, if you are providing the Employee Register – Name it as Working Paper for calculation of Full Time Employees (FTEs)

FAME Advisory’s ESR Audit Service

We have been assisting clients in conducting ESR registration as well as handling ESR audit requirements for them. FAME Advisory prepares the complete documentation and response on the behalf of licensee and ensure that the companies meet the requirement of Economic Substance Test.

This article summarizes all the practical aspects that we have dealt with so far, while handling ESR audit process for our clients. It will help you at the time of your ESR Audit. Keep this as your guide and avoid rush in preparing your audit response within just 5 days.

If you want assistance in preparing your ESR Audit response, feel free to reach FAME Advisory DMCC.

Leave a Reply

Your email address will not be published. Required fields are marked *